Will there be at least Credit score to own Va Financing?

What is the Lowest Credit score to have Virtual assistant Loan?

Kept in-mind you to particular lenders might require a higher credit rating, according to the borrower’s full financial situation and other factors.

What’s the Reasonable Credit score to possess Va Financing?

As Va cannot place at least credit score criteria, really Va lenders possess their particular lowest credit score requirements.

Which are the Benefits associated with a great Va Mortgage?

Va finance are a form of home mortgage which is protected because of the You.S. Agencies off Experts Activities (VA) and that is built to help active-duty military people, pros, and you will qualified enduring partners to shop for a home and no down payment.

- Zero Advance payment: One of the several great things about a great Va loan is actually one qualified individuals can buy a house in the place of and then make a down fee.

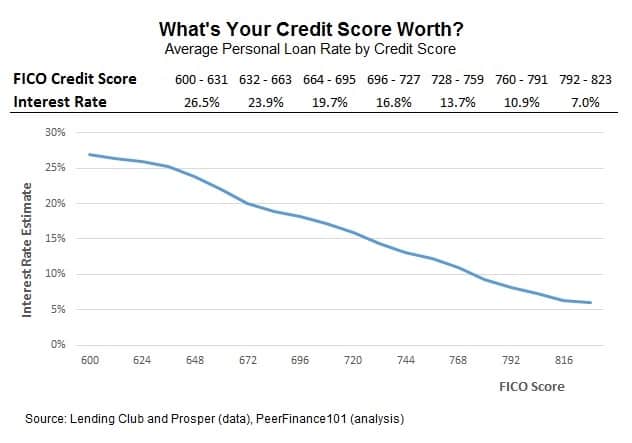

- Straight down Interest rates: Virtual assistant money typically come with down rates than just traditional fund, which can save yourself individuals thousands of dollars across the longevity of the mortgage.

- No Financial Insurance policies: Borrowers are not expected to pay money for individual home loan insurance policies (PMI) since the Va money is supported by the us government.

- A great deal more Lenient Credit Requirements: Virtual assistant financing convey more lenient borrowing from the bank conditions than many other style of finance, making them a good idea getting consumers that have smaller-than-perfect borrowing from the bank.

- Versatile Repayment Words: Va loans bring versatile fees words, also 15 and 31-12 months fixed-speed mortgage loans and you will varying-rates mortgages.

- Direction in the event of Financial hardship: When the a debtor feel monetaray hardship, the fresh Va assists with the type of mortgage changes, repayment plans, or other selection. Прочитать блог