Tax Checklist: What You Need to File Your 2023 Taxes

Formulas and functions can be applied to automatically calculate totals, percentages, and other financial metrics, improving accuracy. If you have any questions about the necessary information required to submit a return, it’s a good idea to consult a tax professional. The adjustments to income, also known as line deductions, help you lower your tax burden by reducing your total income.

Retirement plan contributions.

Too many taxpayers rush into this to get their refunds, only to realize later that they missed a W-2 or 1099, meaning they are forced to prepare and file a tax amendment. For individuals and businesses, we have created a printable tax preparation checklist Excel or Google Sheets will find compatible. All you need to do is copy (ctrl+c) the list and then paste (ctrl+v) it into your preferred spreadsheet software.

TURBOTAX DESKTOP GUARANTEES

- You’ll need to show that the funds were used for your business and provide proof of repayment to claim the interest on your business loan.

- We will provide you with a checklist for your finances to streamline your tax filing time, to optimize your day for the things that matter in life!

- You won’t want to be missing a critical piece of information when you’re filing your taxes.

- Properly documenting the taxes you’ve already paid can keep you from overpaying.

- If your mortgage payment includes an amount escrowed for property taxes, that will be included on the Form 1098 your lender sends you.

The reality is that the meal needs to be work-related. So, grabbing lunch with your team while you discuss the latest episode of The Bachelor is not a deductible expense—unless you work on The Bachelor, of course. Download our free, simple, and comprehensive business plan template. Get unlimited advice, an expert final review and your maximum refund, guaranteed. Employers must issue or mail your W-2 by Jan. 31, so keep an eye on your mailboxes, both physical and electronic.

The Ultimate Small Business Tax Deductions Checklist

Any expense related to the vehicle—gas, maintenance, repairs, insurance, registration fees, lease payments, tolls, and more—can be deducted. The cost must be a normal deduction that other established businesses would incur to qualify as a startup expense. But, as a startup cost, these expenses happened before you officially started operating your business. Tax Day is still months away, so use this time leading up to get your financial ducks in a row. Getting everything ready now means you’ll have time to fix errors, make more contributions, or find any missing paperwork.

Businesses should keep copies of articles of incorporation to clarify how the business is structured. This section provides information about who’s filing the taxes, who’s covered in tax returns, and how to deposit the refunds. Both your federal and — if applicable — state return. These aren’t strictly necessary, but they’re good refreshers of what you filed last year and the documents you used.

- The author and Simplicity Financial disclaim any liability for any errors or omissions in the information provided or for any actions taken in reliance on this information.

- Gather all the documents that confirm the money you received during the previous year.

- A bad debt happens when someone owes you money, but there is no way for you to collect it.

- We also recommend highlighting the column next to it and adding checkboxes to keep track of which documents you’ve gathered.

- Maximize your tax season efficiency with our all-inclusive tax preparation guide.

We also recommend highlighting the column next to it and adding checkboxes to keep track of which documents you’ve gathered. Business trips can be a complicated process when it comes to tax deductions. Simply put, the business expenses on a trip are tax deductible. If you have a small business loan from a financial institution, tax preparation checklist excel payments against the loan’s principle aren’t tax deductible. However, there is a chance that you can write off the interest you pay on the loan or a business credit card. You’ll need to show that the funds were used for your business and provide proof of repayment to claim the interest on your business loan.

The Ultimate Tax Checklist to Help You Prepare for Taxes

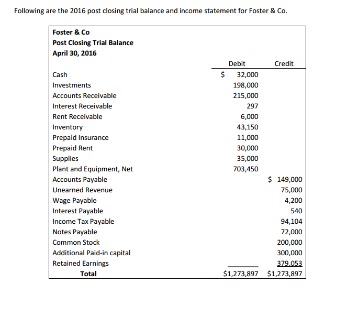

Use the checklist below to gather your documents and other forms that you will need to file your taxes. Not all items may apply; keep track of your forms and store copies for your records once you have e-filed your return. See an overview of taxable income and non-taxable income to see various types of income and whether or not they are taxed. Maximize your tax season efficiency with our all-inclusive tax preparation guide. Access our downloadable tax preparation checklist PDF to streamline your document organization. Stay on track with our vital tax prep checklist tailored for individual filers.

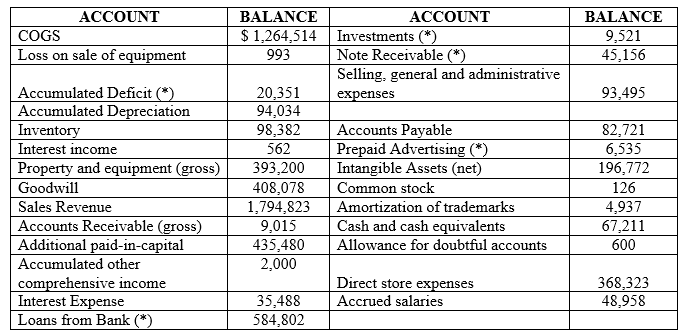

Tax deduction records

Additionally, sole proprietors, partnerships, and LLC owners must claim charitable donations on their personal income tax returns. In order to meet the IRS requirements for filing your income tax returns, you’ll need accurate, up-to-date bookkeeping for the whole tax year. Many of the items on the checklist assume that you already have bookkeeping done (such as the trial balance, which is a summary of your financial transactions over the year). Taxes are an undeniable reality that small business owners have to come to terms with each year. But with the help of a small business tax deductions checklist, you can find the deductions that keep more of your hard-earned money where it belongs—in your pocket.

How Can I Prepare for Taxes?

Secure all of the necessary paperwork now, and you’ll save yourself a whole lot of stress down the road. Have a better understanding of your business’s finances using our https://www.bookstime.com/ free income statement template. Simply import the template into Excel and begin filling out the necessary fields. Use this tax checklist to file your self-employed taxes.