Chase House Financing Also offers Financial and Instructional Tips getting Homebuyers; Increases Closing Be certain that in order to $20,000

Nyc, – The latest homes affordability drama-with high rates of interest, highest property rates, and you may reasonable likewise have-could have been well documented. To assist homebuyers address such demands, Chase Domestic Credit means getting financial resources and you can homebuyer knowledge, as well as expanding their Closure Verify away from $5,000 in order to $20,000.

Newest ics enjoys impacted brand new value out-of homeownership for many People in the us, as well as the same time frame, competition only has enhanced, said Sean Grzebin, direct regarding Consumer Originations to possess Chase Family Credit. The audience is concerned about stuff we can manage inside environment which is support the users all the way home. Expanding our very own Closure Ensure to $20,000 are a representation in our count on in getting users toward their new house immediately.

Has just, the financial institution enhanced which grant off $5,000 so you’re able to $seven,five hundred when you look at the fifteen areas along side You

Pursue offers low down fee options-only 3%-and flexible borrowing guidance to produce way more homeownership ventures for lots more somebody along side income range. Another way Chase are helping people perform affordability is through the brand new Pursue Homebuyer Give. It offer offers so you’re able to $7,five hundred in the qualified section, and that is combined with condition and local homebuyer recommendations, to reduce the speed and you can/or beat closing costs and you may downpayment.

As the 2020, Chase provides more $96 mil in the Chase Homebuyer Grant funds for over 30,000 users. Within the 2023, Pursue plus linked homeowners that have as much as $fifteen.8 billion inside the county and regional homebuyer and down-payment advice software. Consumers are able to use Chase’s Homebuyer Direction Finder to analyze guidance programs whereby they can be qualified.

I’d advise users and make lenders vie to suit your needs-take time to consult with multiple financial and check together with your bank

Pursue launched the offer system across https://elitecashadvance.com/personal-loans-ri/kingston/ the nation when you look at the 2018 that have an effective $dos,500 grant for all those to get in the lower-to-moderate earnings census tracts. After that from inside the during the 2021, the bank introduced a good $5,000 homebuyer give in the census tracts appointed because the bulk-Black colored, Hispanic otherwise Latino under its Special-purpose Borrowing from the bank Program (SPCP), according to the government conditions of one’s Equal Credit Possibility Work (ECOA) and you can Control B. S.:

- Atlanta, GA

- Chi town, IL

- Dallas, Tx

- Fort Lauderdale, Florida

- Fort Worthy of, Tx

- Houston, Tx

- Las vegas, NV

- Los angeles, California

- Miami, Fl

New homebuying process will be daunting, whether you’re a primary-date or knowledgeable homebuyer. Pursue are assisting to educate possible consumers towards the inches and you will outs of the property purchase techniques, homeownership and you may everything in ranging from. The new JPMorgan Pursue Institute has just put-out look contacting from pros to possess users to-be educated with regards to the home loan and you may bank possibilities. The latest Institute’s statement, Hidden Can cost you of Homeownership: Battle, Earnings, and you will Lender Differences in Mortgage Settlement costs, shows that closing costs differ somewhat by the form of financial, that have financial institutions are inexpensive on average than simply nonbanks and you can agents.

Homeowners never always discover what is negotiable and you will just what can vary of lender so you can bank, told you Grzebin. Being informed may help save some costs in the end.

Most resources become Chase’s Homebuyer Training Cardiovascular system-a comprehensive training heart of these looking to purchase property and now have home financing. Chase’s prize-successful podcast, Student So you’re able to Client arrives filled with one or two seasons from periods offering conversations that have actual consumers and you may pro site visitors sharing homebuying and ownership, domestic equity, popular misconceptions, renovations, and you may funding qualities.

An instant closure procedure are secret, especially in competitive items. The newest Pursue Closing Guarantee commits to an in-big date closing inside the as soon as about three weeks otherwise eligible people get $20,000. That it short period of time offer can be found having being qualified customers to acquire an effective home with an effective Pursue mortgage until . People must submit expected financial paperwork and gives a fully-executed purchase deal. Following, Chase usually close the loan toward or before the offer closing date otherwise spend the money for consumer $20,000. Money can be used to dismiss underwriting fees repaid at mortgage closing or reduce the pace and you can downpayment.

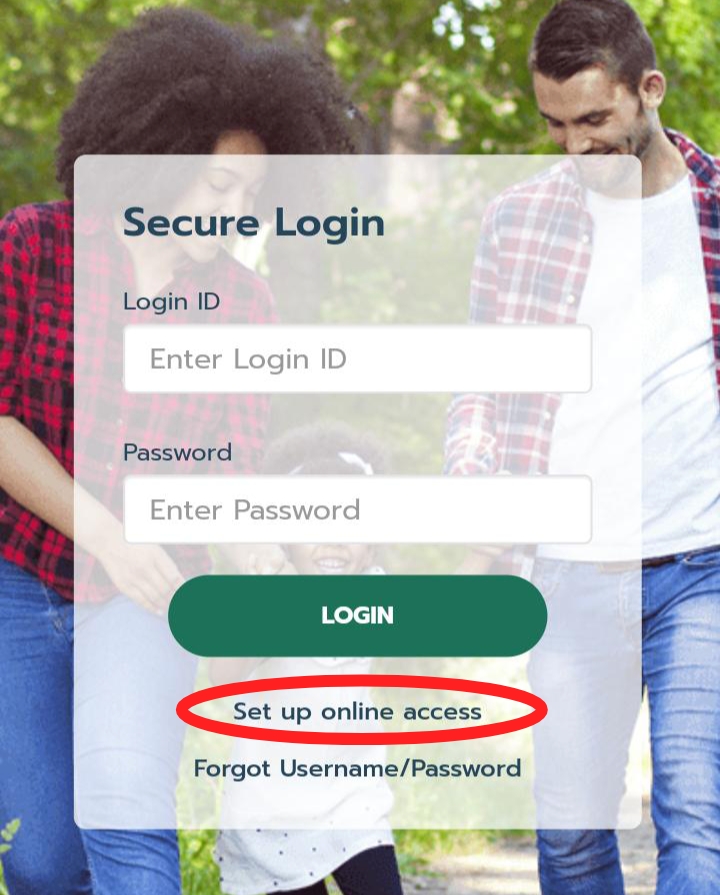

Pursue will continue to render an entire package out of digital equipment to assistance consumers on the road to homeownership, along with Pursue MyHome. That it electronic platform provides everything domestic, everything in one place which have an enhanced assets look therefore the capacity to review financing options, sign up for and control your mortgage. Simultaneously, Chase now offers various electronic financial hand calculators that help customers recognize how far they may be able afford.