Will there be at least Credit score to own Va Financing?

What is the Lowest Credit score to have Virtual assistant Loan?

Kept in-mind you to particular lenders might require a higher credit rating, according to the borrower’s full financial situation and other factors.

What’s the Reasonable Credit score to possess Va Financing?

As Va cannot place at least credit score criteria, really Va lenders possess their particular lowest credit score requirements.

Which are the Benefits associated with a great Va Mortgage?

Va finance are a form of home mortgage which is protected because of the You.S. Agencies off Experts Activities (VA) and that is built to help active-duty military people, pros, and you will qualified enduring partners to shop for a home and no down payment.

- Zero Advance payment: One of the several great things about a great Va loan is actually one qualified individuals can buy a house in the place of and then make a down fee.

- Straight down Interest rates: Virtual assistant money typically come with down rates than just traditional fund, which can save yourself individuals thousands of dollars across the longevity of the mortgage.

- No Financial Insurance policies: Borrowers are not expected to pay money for individual home loan insurance policies (PMI) since the Va money is supported by the us government.

- A great deal more Lenient Credit Requirements: Virtual assistant financing convey more lenient borrowing from the bank conditions than many other style of finance, making them a good idea getting consumers that have smaller-than-perfect borrowing from the bank.

- Versatile Repayment Words: Va loans bring versatile fees words, also 15 and 31-12 months fixed-speed mortgage loans and you will varying-rates mortgages.

- Direction in the event of Financial hardship: When the a debtor feel monetaray hardship, the fresh Va assists with the type of mortgage changes, repayment plans, or other selection.

Overall, Va loans is a option for qualified consumers, as they promote significant pros that can assist all of them get an effective house with little money off, down rates of interest, and a lot more lenient borrowing conditions.

Exactly why are Virtual assistant Mortgage Fico scores Less strict?

Because Va claims part of the financing to help you lenders for people who default, lenders have the ability to undertake a lot more risk than just along with other systems out of funds.

Understand that this new Va cannot funds finance, but rather, they spend loan providers (banks) backup to twenty five% of your own loan amount for those who default on your Va financing.

Since the Virtual assistant try trying out a few of the risks, lenders could offer best rates if you are delivering even more self-reliance to the fico scores and other official certification.

not, even with the fresh new VA’s guaranty, loan providers tend to nonetheless feedback a borrower’s creditworthiness to determine the eligibility having an excellent Virtual assistant loan.

Really does a top Credit history Suggest a better Virtual assistant Financing Rate?

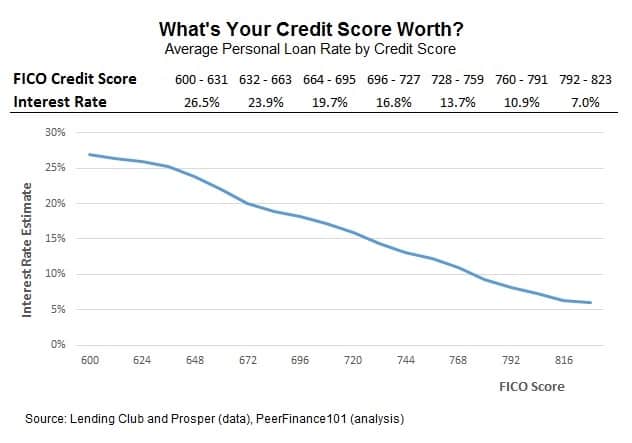

Sure, with a top credit history can make it simpler to meet the requirements having an excellent Va loan and you may safe a great deal more favorable mortgage terms and conditions, such as a lower life expectancy interest rate and lower monthly installments.

Good credit (above 620) and suggests the lender the debtor try responsible with borrowing from the bank and that is likely to pay the borrowed funds promptly.

And credit score, Virtual assistant lenders also comment other factors when making a credit decision, including the borrower’s earnings, work record, debt-to-earnings proportion, and full finances.

It’s important to keep in mind that though a debtor fits the new lowest credit score criteria, they still have to satisfy almost every other Virtual assistant loan qualifications criteria, along with that have a valid Certificate off Qualification (COE) and you can meeting brand new lender’s income and you can debt criteria.

Conclusion: Virtual assistant Loan Credit rating Conditions

To close out, the latest Virtual assistant mortgage system doesn’t have at least borrowing rating requirement set by Va, but most lenders wanted a credit rating from 580 so you’re able to 620.

Which have a higher credit history helps it be simpler to meet the requirements to have an effective Va mortgage and you may safe alot more good financing words.

If you find yourself a seasoned otherwise energetic-responsibility services user given a Virtual assistant mortgage, its essential to manage an established Va bank who’ll guide you through the techniques and help you are sure that the choices.

Wanted a great Rate on your own Va Financing? We can Let!

- District Lending is on a mission to help you disturb the standard mortgage community. Buying property is going to be incredibly challenging so we made a decision to allow it to be Effortless due to the technology and you will exceptional customer care!

- Straight down costs. No financial costs. Since the a mortgage broker, we work at more than ninety lenders (banks) for you. As a result users convey more choices to pick, which makes it easier to discover the best you are able to mortgage and you will speed. Why are us additional would be the fact we’re able to bring great reasonable rates in order to people everyday (we have very low overhead with no levels out of overpaid middle management).

- We have been extremely fast to close off, but do not cut sides. There is designed our very own way to romantic financing in the only a small amount due to the fact 10 weeks. We along with screen the competitors’ rates and always guarantee that ours was straight down.

Shortly after employed in the borrowed funds world having 20 years, I become Section Financing to transmit customers down prices and sleeve them with the advantage and also make confident economic conclusion. Which is in addition to why I’m drawn to putting some to order and refinancing feel once the seamless and you may worry-free you could. We well worth sincerity, therefore i gladly express my costs which have customers right on the latest web site. All of our provider was clear, and no credit loans Oneonta AL we prioritize shopping for the new buyer’s best interest.

Due to the fact a military experienced, You will find managed to get my personal life’s objective to help individuals live delighted and richer lives. District Credit will bring which purpose to life. We believe during the integrity, trustworthiness, and you will transparency, this is the reason you will see our very own cost close to the site. There are down prices and you will no credit charges, so that you can obtain your dream family for less. This new discounts was passed on for your requirements – the way it can be.